Sunlife of Canada Quiz Night

Everybody had a blast at the Sun Life sponsored event at the Fort, BGC. There were 26 groups composed of 6 to 8 members each who participated in the event.

The fastest hands who googled the answer with the fastest connection wins the quiz. Congratulations guys!

I took the wrong route going to BGC that unfortunate day. Instead of taking the LRT/MRT route for easier and faster access to BGC. I took the jeepney going to Dapitan from Taft. In Dapitan, I walked towards Mayon Street, rode a jeep to Welcome Rotonda then cross the highway and rode an FX going to Trinoma then walk towards the MRT on the other side of the road then took the MRT, then upon arrival at Ayala MRT Station, went down the stairs then walked towards the BGC Bus terminal and waited in a crazy long line of people for almost thirty minutes to ride the West bound BGC bus before walking at my final destination at the Fort in BGC. Because of my bad decision, I never made it to the event proper. Good thing, the PR allowed me to join the Sun Life sponsored quiz night later that evening at the tent near the BGC Signage at the Fort.

Wrong Route.

The word is not only applicable on how we move from one place to another. This also applies with our financial dealings.

I know of some guys who took the easy route. Networking. The rich quick scheme. "Kape tayo" statement became synonymous to an hour of horror listening to all their talks convincing you to invest on their networking and what have you. Again, maybe they mean well but then again I am not just interested now. Why? It's because of a former schoolmate who asked me to joined a networking selling all those powdered drinks that they claimed to make you healthy, unfortunately the three heads I bought was all for nothing because she left me to fend on my own. Well, that made me realized that she's there only for the money not to help me make money. So there's a big difference there. So be careful on whom to trust.

Horror of horrors, reconnecting with lost friends and schoolmates, classmates etc. to extract money from them is a bit overboard. But that was what was being taught at their trainings. So, I guess, I'll list that as one of my charitable acts. Very costly, not only with the amount of money I paid but also with the friendship that had gone with my money. Ha ha ha!

Networking in the Philippines is not matured enough unlike those of other countries. It is primarily based on pyramiding that when the cookie crumbles everything else smashes to the ground.

One other way is to bank on your good looks and talent. Enter the entertainment scene as an actor or actress. Or if you have a singing prowess then by all means try to be a singer. Or if you don't have the talent maybe just maybe you could become the next Anne Curtis and enjoy fame and money that comes with it.

Another way is working your way to the top in the corporate scene. The stressfull rat race. A lot of you thinks that working in a multinational corporation would give you all the comforts in life. Well, maybe it holds true to some but not with everyone.

The route I took is entrepreneurship. Lesser number of people my age took the route I choose. Business after all is not for everyone. Yes, think again and again before you jump into your own business. Business needs 100% of your time and attention. You have to make sacrifices, and it is definitely for everyone.

According to studies. More than 90% of businesses closed down within two (2) years of operation. Another 50% closed down after five (5) years in operation. Not everyone has the patience and the financial savvy to remain on top of his game. Not everyone are taylored to be an entrepreneur.

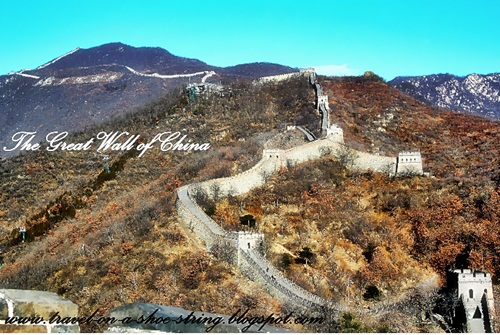

The ups and downs, twists and turns in this hilly terrain is really very challenging. The turbulence could come up anytime of the day that when you are caught unprepared you'll be swept off your feet. Endangering all your hard work. Yes, even in business you could lose everything. So thread lightly.

Another way I know is combining business or work with investments. That means, you still work or do business while segregating a portion of your income for your investments. In short, you make your money work for you and not the other way around. Re-investing your investments.

As you all know, bank deposits nowadays earns less than 1% annually. And if your account falls below the regulated balance it will be automatically be labeled dormant. Poor you will end up with nothing as in NADA, Zero. Sad, but true.

I don't know who had that crazy idea implemented in the banking industry. It made a lot of people frustrated, angry even. Your hard earned money gone with the wind. I could not blame people who just stock their money at home in their piggy bank. It made them feel more secure and safe than depositing their money in the bank.

Another way is to bet in the lotto. Unfortunately, according to studies, it is more possible for you to be stricken by the thunder twice than to win the lotto. Sigh, it is a very depressing thought. What will the future brings then? No one knows for sure. But you can choose to get ready by making investments as early as today. Make plans. Make a dream board. Take some notes and invest in your own future.

Mutual funds, stocks, UITF, bonds, etc. you name it I tried it. Yes, I've tried all of these instruments. And yet, I am not 100% convinced especially when it comes to the stockmarket. Why? Because in the past, I tried dipping my fingers inside the boiling kettle without proper guidance or knowledge on what I was getting into and I ended up with nothing. All my money went puff. Hays!

That is why I appreciate it when Aya Laraya was tapped by Sun Life of Canada to conduct a series of workshops dubbed as "Aral Muna, Bago invest".

Good thing, Sun Life of Canada is bending backwards in order to give its clients a chance to know its products. I learned recently that Sun Life offers fund management for as low as Php5,000

You must have a specific purpose for your funds. Whether it is for retirement, education, travel, gadgets, etc. Because a purpose well defined is eaily attainable than a man with no particular purpose. A man who could not make up his mind is like a loose cannon, trying to be everything ending up with nothing.

Your Sun Life fund manager will be the one to take care of your funds while you enjoy a good quality of life. Of course, you have to pay certain fees when you withdraw your investments before the holding period ends. Holding period is about a year or two depending on the type of investments you made.

I am so excited. I want to try this Sun Life product. #ExcitedMuch

#MatteoGuidicelli #MillenialAmbassador #SunLifeProsperityCard #SunLife #QuizNight #SunLifeOfCanada #SunLifePhilippines #BrightLife #BrighterFuture #Sun #travelonshoestring #Bright

Everybody had a blast at the Sun Life sponsored event at the Fort, BGC. There were 26 groups composed of 6 to 8 members each who participated in the event.

I took the wrong route going to BGC that unfortunate day. Instead of taking the LRT/MRT route for easier and faster access to BGC. I took the jeepney going to Dapitan from Taft. In Dapitan, I walked towards Mayon Street, rode a jeep to Welcome Rotonda then cross the highway and rode an FX going to Trinoma then walk towards the MRT on the other side of the road then took the MRT, then upon arrival at Ayala MRT Station, went down the stairs then walked towards the BGC Bus terminal and waited in a crazy long line of people for almost thirty minutes to ride the West bound BGC bus before walking at my final destination at the Fort in BGC. Because of my bad decision, I never made it to the event proper. Good thing, the PR allowed me to join the Sun Life sponsored quiz night later that evening at the tent near the BGC Signage at the Fort.

Wrong Route.

The word is not only applicable on how we move from one place to another. This also applies with our financial dealings.

I know of some guys who took the easy route. Networking. The rich quick scheme. "Kape tayo" statement became synonymous to an hour of horror listening to all their talks convincing you to invest on their networking and what have you. Again, maybe they mean well but then again I am not just interested now. Why? It's because of a former schoolmate who asked me to joined a networking selling all those powdered drinks that they claimed to make you healthy, unfortunately the three heads I bought was all for nothing because she left me to fend on my own. Well, that made me realized that she's there only for the money not to help me make money. So there's a big difference there. So be careful on whom to trust.

Horror of horrors, reconnecting with lost friends and schoolmates, classmates etc. to extract money from them is a bit overboard. But that was what was being taught at their trainings. So, I guess, I'll list that as one of my charitable acts. Very costly, not only with the amount of money I paid but also with the friendship that had gone with my money. Ha ha ha!

Networking in the Philippines is not matured enough unlike those of other countries. It is primarily based on pyramiding that when the cookie crumbles everything else smashes to the ground.

One other way is to bank on your good looks and talent. Enter the entertainment scene as an actor or actress. Or if you have a singing prowess then by all means try to be a singer. Or if you don't have the talent maybe just maybe you could become the next Anne Curtis and enjoy fame and money that comes with it.

Another way is working your way to the top in the corporate scene. The stressfull rat race. A lot of you thinks that working in a multinational corporation would give you all the comforts in life. Well, maybe it holds true to some but not with everyone.

The route I took is entrepreneurship. Lesser number of people my age took the route I choose. Business after all is not for everyone. Yes, think again and again before you jump into your own business. Business needs 100% of your time and attention. You have to make sacrifices, and it is definitely for everyone.

According to studies. More than 90% of businesses closed down within two (2) years of operation. Another 50% closed down after five (5) years in operation. Not everyone has the patience and the financial savvy to remain on top of his game. Not everyone are taylored to be an entrepreneur.

The ups and downs, twists and turns in this hilly terrain is really very challenging. The turbulence could come up anytime of the day that when you are caught unprepared you'll be swept off your feet. Endangering all your hard work. Yes, even in business you could lose everything. So thread lightly.

Another way I know is combining business or work with investments. That means, you still work or do business while segregating a portion of your income for your investments. In short, you make your money work for you and not the other way around. Re-investing your investments.

As you all know, bank deposits nowadays earns less than 1% annually. And if your account falls below the regulated balance it will be automatically be labeled dormant. Poor you will end up with nothing as in NADA, Zero. Sad, but true.

I don't know who had that crazy idea implemented in the banking industry. It made a lot of people frustrated, angry even. Your hard earned money gone with the wind. I could not blame people who just stock their money at home in their piggy bank. It made them feel more secure and safe than depositing their money in the bank.

Another way is to bet in the lotto. Unfortunately, according to studies, it is more possible for you to be stricken by the thunder twice than to win the lotto. Sigh, it is a very depressing thought. What will the future brings then? No one knows for sure. But you can choose to get ready by making investments as early as today. Make plans. Make a dream board. Take some notes and invest in your own future.

Mutual funds, stocks, UITF, bonds, etc. you name it I tried it. Yes, I've tried all of these instruments. And yet, I am not 100% convinced especially when it comes to the stockmarket. Why? Because in the past, I tried dipping my fingers inside the boiling kettle without proper guidance or knowledge on what I was getting into and I ended up with nothing. All my money went puff. Hays!

That is why I appreciate it when Aya Laraya was tapped by Sun Life of Canada to conduct a series of workshops dubbed as "Aral Muna, Bago invest".

Good thing, Sun Life of Canada is bending backwards in order to give its clients a chance to know its products. I learned recently that Sun Life offers fund management for as low as Php5,000

You must have a specific purpose for your funds. Whether it is for retirement, education, travel, gadgets, etc. Because a purpose well defined is eaily attainable than a man with no particular purpose. A man who could not make up his mind is like a loose cannon, trying to be everything ending up with nothing.

Your Sun Life fund manager will be the one to take care of your funds while you enjoy a good quality of life. Of course, you have to pay certain fees when you withdraw your investments before the holding period ends. Holding period is about a year or two depending on the type of investments you made.

I am so excited. I want to try this Sun Life product. #ExcitedMuch

#MatteoGuidicelli #MillenialAmbassador #SunLifeProsperityCard #SunLife #QuizNight #SunLifeOfCanada #SunLifePhilippines #BrightLife #BrighterFuture #Sun #travelonshoestring #Bright